ABOUT TRUSTS

Establish your Trust well in advance of when you need it!

Although Family Trusts have become popular recently they have been with us in one form or another for more than 400 years. Their basic nature remains much the same, but their role has evolved to meet the needs of each generation.

Should you use a Trust to protect your assets?

Assets can be put at risk in a number of different ways. These can include business failure, legal action or a relationship breakdown. We also do not know what the future holds. Government policy can change on a whim; bringing risks to the value of those assets we have strived so hard to acquire.

Will we get a Capital Gains Tax or will the Asset Testing Regime be extended to other Government Benefits? We live in volatile times and there are no guarantees the Government policies we have now will be here next year.

When someone who owns assets and perceives that these could be put at risk or could have some potential for loss, that person would therefore look to divest or remove themselves from those assets, but still enjoy the use and control of them. To continue to do so they will then look to transfer the assets to Trustees of their Trust. The Trustees then hold these assets on behalf of the family group, rather than the individual.

It is common in New Zealand for those who establish the Trust to be kept in total control of this new entity, as most fear that they will otherwise lose control of their assets. Most would agree that in order to achieve this control you must also be a Trustee. We would agree with this advice, however we maintain that you cannot possibly control something that you simply do not understand. This, in our view, is where Trusts have the potential to be challenged, as the individuals that are in ‘control’ of the Trust simply do not understand the new position that they take. At New Zealand Trustee Services, we look to educate – as it is only with knowledge that you can successfully administer and control your Trust.

A correctly structured Trust can secure your assets for future generations – in exactly the manner you wish to preserve those assets.

For instance, inherited funds are separate property until they are used within a relationship. At that point they become relationship property and your child could potentially lose half of them through a separation. At the time of your death, your child may be going through some business or creditor issues. If that were the case, your assets could go to satisfy creditors rather than to support your child or grandchildren.

Protect Separate Property

Trusts are often used when individuals have separate property they do not wish to intermingle with their relationship property. If the separate property is placed in a Trust, they no longer own it and it can then be kept separate from relationship property. This is particularly important for those people who have just left a relationship or have property they wish to protect prior to forming a new relationship.

Reduce Risk of Asset Loss Through Business Failure

New Zealand is a country of small businesses and unfortunately some of them do not trade successfully. Placing your assets in a Trust may help protect your family in the event of a business failure.

Reduce Risk of Loss of Assets Through Legal Action

As a country we seem to be becoming more litigious in nature. If your business is one that could expose you to a legal action through advice or actions, you may wish to protect your family by placing your assets into a Trust.

Gain Taxation Benefits

When income is received in a Trust the Trustees can elect to either retain income within the Trust or allocate it to a beneficiary. This decision should be made in conjunction with the Trust’s Accountant.

Note: The timing in respect of the establishment of the Trust is critical as protection takes time, there are very few immediate gains for any Trust, therefore the formation of a trust should occur when you do not need this protection immediately. Advice on forming a Trust for this or any other purpose should be sought via New Zealand Trustee Services’ Trust Managers.

PEACE OF MIND

As our client, you can relax in the knowledge that we can manage your trust in a timely and cost effective manner, and over generations.

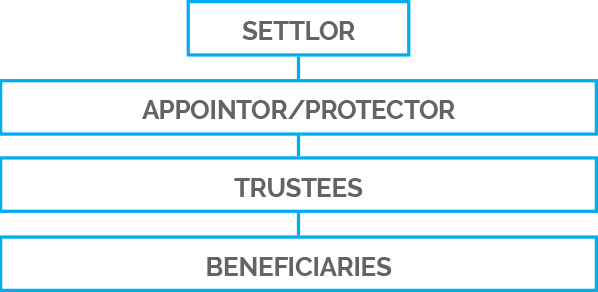

To form a Trust, a Trust Deed is prepared and signed. The Trust Deed specifies who the Settlor, Trustees and Discretionary Beneficiaries are. The Trust Deed also provides the Trustees with a full range of administrative powers. This allows the Trustees to undertake virtually any action an individual could do. Next, we’ll explain the role of the Settlor, the Trustees and who should – and should not – be included as a Beneficiary of your Trust.

Settlor

The Settlor only has three roles, the first being to establish the parameters of the Trust, the second to appoint the Trustees and the third to select the assets that they wish to be held by this Trust. The term ‘Settlor’ should not be referred to in the body of the Trust Deed, particularly where the ‘Settlor’ has the ability to ‘hire and fire’ Trustees |and also ‘add or remove Discretionary Beneficiaries. These powers should be held by the ‘Appointor/Protector’ or the ‘Trustees’.

Appointor/Protector

The Appointor/Protector is the individual(s) who has the ability to ‘hire and fire’ the Trustees. They should also provide their prior written consent to the Trustees where there is an occasion to ‘add or remove’ Discretionary Beneficiaries.

Trustees

The role of the Trustees is to control the Trust and ensure it remains compliant, to make the decisions and to record these decisions, to meet annually and effectively hold the assets that are now owned by the Trust on behalf of the Beneficiaries of this Trust, and to invest these assets in a prudent manner.

Beneficiaries

The Beneficiaries or Discretionary Beneficiaries are those people you intend to benefit from the Trust. These people should be specifically named. Future or former partners should not be mentioned at all.

Gifts to Trusts – Post Gift Duty

With the abolition of Gift Duty a Trustee needs to consider the manner in which gifts are accepted, either as one large gift or many smaller ones under a Gifting Programme. The main point is that a Trustee should receive the gift with ‘clean hands’ (to be sure in their knowledge that they can properly exercise the discretions given to them). To do this, a Trustee should be sure that the Donor (person making the gift) has the ability to make the gift without the fear of it being clawed back at a future stage. To do this, we believe it is appropriate for a Trustee to make proper enquiries of a Donor before accepting the gift.

What are the Risks?

Business Trading

The clients business will trade unsuccessfully to a point where the Debts can no longer be serviced through income. At that point, a Receiver will be appointed to sell the Business Assets and use the proceeds to cover these debts. The client (personally) will be asked to make up any shortfall. Law – Section 346 & 348 of the Property Law Act 2007 – Sections 204 & 205 Insolvency Act 2006.

Question: At any stage, all trading Businesses have Debt. If the income stream from the Business were to suddenly cease would the client have sufficient assets to meet the current liabilities as they fall due? If so, would the disposition of property into a Trust change that position so that the client would no longer be able to cover the Debt?

Legal Actions

The Client provides advice or a service on which customers rely. The Failure of that advice or service would cause a loss to the Customer and the Customer would seek to recoup the loss from the Client. Law – Section 346 & 348 of the Property Law Act 2007.

Question: All Advisors or Service Providers have the potential of a claim being made against them. Is the client aware of any particular claim being brought against him/her at this time? If so, would the disposition of property into a Trust mean that the client would be unable to meet that claim if it were successful?

Separate Property

The client has separate property prior to a relationship forming. If that separate property is used within the relationship or contributions are made to it that may change the status of the asset to relationship property.

Law – Section 44 of the Property (Relationships) Act 1976.

Questions:

- Is the client in a relationship?

- If so, how long has the relationship been going?

- Has the Partner done anything to add value to the property?

- Has the Partner helped service debt on the property?

- Has the Partner worked in the home to allow the Client to earn an income?

Succession Planning – Residential Care

The client has an important family asset which they want to pass on to a family member intact. Long term residential care may impact on the clients abilities to pass the property on intact. Law – Section 9b of the Social Security (Long Term Residential Care) Regulations 2005.

Question: The Disposition of an asset into a Trust may remove the asset from your ownership, but would the client have sufficient resources outside the Trust to meet the costs of Long Term Residential Care? If not, would the client have to apply for a subsidy and would an ‘Excess Gifting’ assessment put the client over the exemption limit?

Note: Excess Gifting is not time bound (the above regulations are completely retrospective)

Succession Planning – Family Protection Act

If a client is wishing to significantly benefit one family member over the others, one large gift to an Inter-Vivos Trust may be the best way to achieve this without the risk of having the forgiveness of any residual Debt contested under the Family Protection Act 1955.

Question: Does the client have any major assets they wish to pass on intact to one family member without equalizing these amongst the other family members?

Deeds of Gift

The forgiveness of any existing gift or the transfer of an asset requires a Deed to properly record the intention to gift. As Trustee, we believe that the Deed of Gift represents a good opportunity to record that the Trustees have considered all the relevant circumstances around the gift and believe that they can receive the gift without any obligation to any other party. Apart from the practical matter of transferring the asset as Trustee, we will also record the following:

- That after making the gift, the Donor has the ability to meet his/her debts as they fall due;

- That the Donor is not aware of any potential legal action that may be made against him/her and making the gift would not have result of prejudicing the Claimant;

- That the property being gifted is separate property and the gift would not deprive any partner of their property rights;

- That the gift is not being made with the purpose of gaining financial assistance from a Government Agency.